Cowichan Valley Market Update July 2023

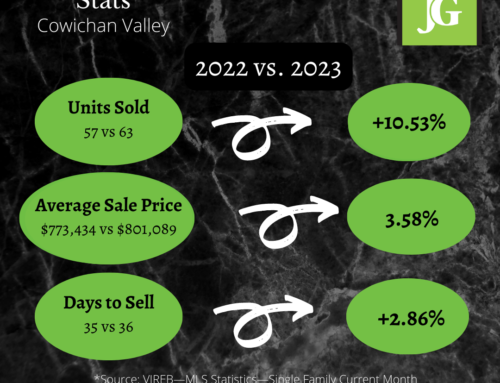

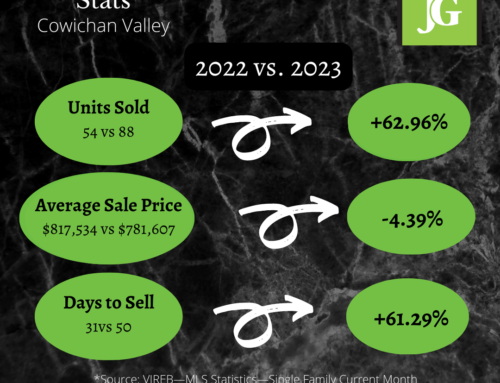

Vancouver Island Real Estate Board Statistics for June 2023 are out and we were pleasantly surprised to note a 1.10% uptick in the average sale price of a Cowichan Valley single family detached home from $798,401 in June of 2022 to $807,179 thru June of 2023. Despite this marginal increase, the average sale price has still dropped by 25.94% over the last 12 months to date.

Inventory took a slight dip with 153 single family units reported listed in June of last year over 146 in June of this, but continues to build, up 7.57% overall in the last 12 months. Still seemingly insufficient to satisfy demand but growing. The number of active listings and the number of units sold thru June also increased as did the number of days to sell for most types of real estate.

Homes at the lower end of the market (under the $700/800K mark) are moving a bit faster and even still occasionally seeing multiple bids while the market for homes nearing or over the $1M mark is relatively flat. Increasing interest rates have reduced many would be home buyers purchase power, forcing them to look to the lower end of the market or forgo purchasing altogether. Sellers should regularly review their asking price to ensure it is meeting current market conditions and many are having to consider reducing in order to attract a serious buyer.

In a nutshell, prices are still trending down but not at the rate many experts predicted, inventory continues to grow and homes are taking a little longer to sell as buyers now have more to choose from and more time to satisfy offer conditions such as financing and inspections.

With the most recent Bank of Canada rate hike, now is a good time to remind buyers to get pre-approved and lock in your rate! Most lending institutions will offer a 60-90 day rate hold once you have your pre-approval in place so you can shop with confidence and not lose purchase power if rates increase again while you’re looking. Don’t skip this most crucial first step in the house hunting process, it could save you money (and heartache) in the long run!

A lot of factors are at play in our current market. Bigger down payment requirements, rising interest rates, tougher lending qualifications and limited inventory are having an impact on both Buyers and Sellers. Having a Real Estate professional on your side to help guide you is essential. Don’t hesitate to get in touch if you are considering a move and need assistance. We’re here to help!